Introduction:

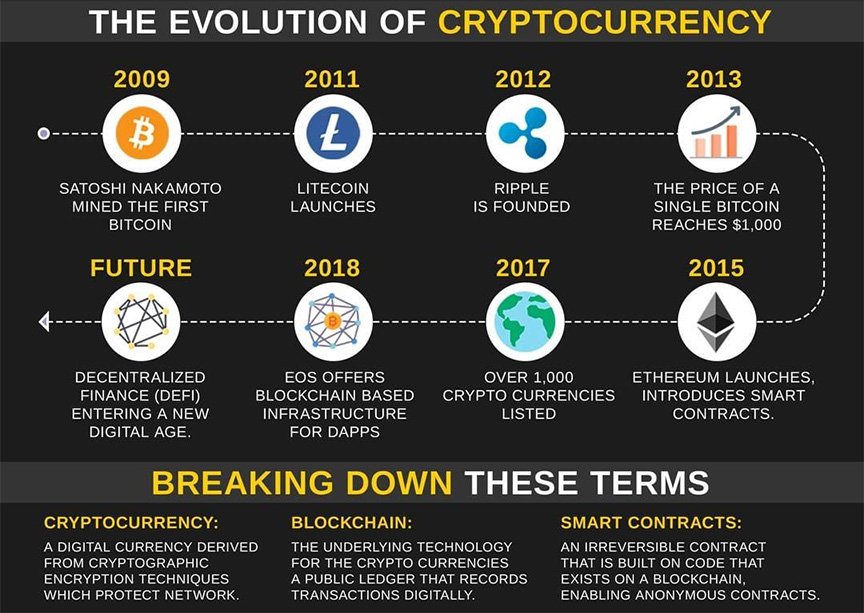

In a world where financial systems are rapidly evolving, crypto finance has emerged as a game-changer. With the rise of Bitcoin, Ethereum, and thousands of other cryptocurrencies, we are witnessing a shift from traditional banking systems to decentralized digital finance. But is this just a trend, or is crypto the future of money?

This blog dives deep into the world of crypto finance — what it is, why it matters, how it works, and how you can be a part of this financial revolution that’s here to stay.

What is Crypto Finance?

Crypto finance refers to financial systems that use cryptography, blockchain technology, and digital assets to enable secure, transparent, and decentralized financial transactions.

Key elements include:

- Cryptocurrencies (like Bitcoin, Ethereum, Solana)

- DeFi (Decentralized Finance) protocols

- Crypto wallets

- Smart contracts

- NFTs and tokenized assets

Why Crypto Finance is Not Just a Fad

- Decentralization

Unlike traditional banks controlled by governments or central authorities, crypto operates on decentralized networks. This means no single point of failure and greater transparency. - Financial Inclusion

Crypto opens up banking services to the unbanked and underbanked populations, especially in developing countries. - Low Transaction Costs

Sending money across borders using crypto is faster and cheaper than using traditional banks or money transfer services. - Transparency and Security

Transactions on the blockchain are immutable and traceable, reducing fraud and corruption.

How Crypto Finance is Changing the World

- Smart Contracts automate agreements without intermediaries.

- Stablecoins offer price stability and can be used for payments and savings.

- Tokenization is transforming real estate, art, and investments.

- Yield farming & staking allow passive income from crypto holdings.

- Web3 and decentralized apps (DApps) are building a new internet.

Top Use Cases of Crypto Finance (Real-World Impact)

Crypto finance is already transforming real-world industries across the globe. One of the most powerful use cases is cross-border payments, where individuals and businesses can transfer money internationally with lower fees and faster processing times compared to traditional banks.

In many developing countries, remittances powered by crypto help families receive support within minutes, without high middleman charges. Another revolutionary area is DeFi (Decentralized Finance) lending and borrowing, which allows people to earn interest or take out loans without involving banks — all managed by transparent smart contracts.

Additionally, investment and trading opportunities in crypto markets are gaining traction due to their high potential returns, despite volatility. New digital economies are also emerging, especially in gaming and the metaverse, where users can earn cryptocurrencies by participating in virtual worlds — a concept known as Play-to-Earn.

Moreover, crypto-based crowdfunding and charity platforms are offering full transparency, ensuring that funds reach the intended beneficiaries without delays or misuse. These real-world use cases prove that crypto finance is not just a concept but a working system already creating real impact.

Risks to Consider

While the potential is huge, it’s important to know the risks:

- Volatility: Crypto prices can swing rapidly.

- Security threats: Wallets and exchanges can be hacked.

- Regulatory uncertainty: Rules differ across countries.

- Scams & frauds: Stay alert and do your research.

How to Get Started with Crypto Finance

- Learn the basics (through blogs, YouTube, or online courses)

- Choose a secure wallet (e.g., Trust Wallet, MetaMask)

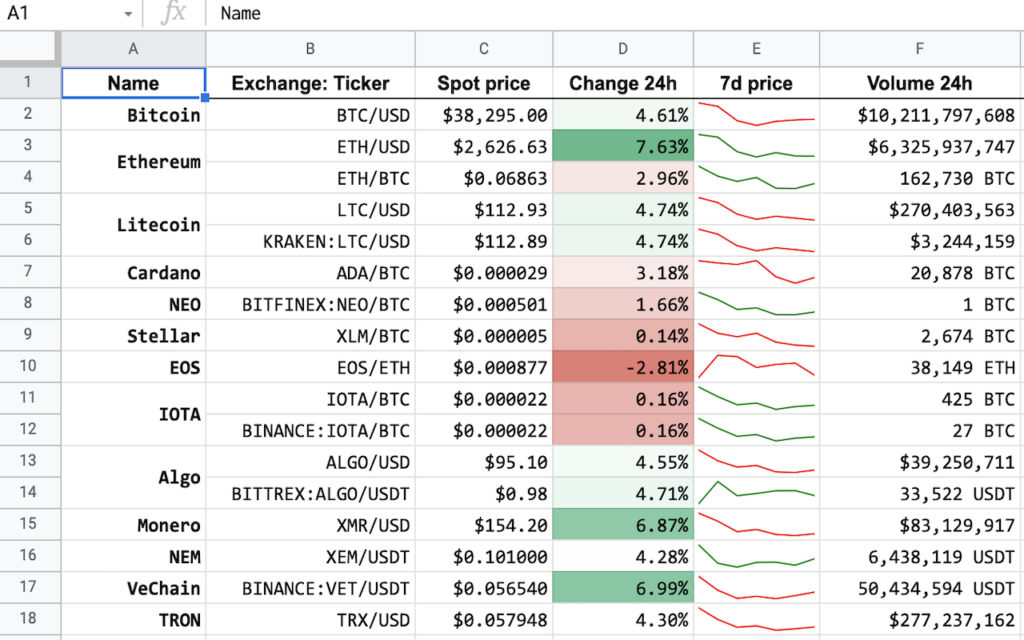

- Use reputable exchanges (like Binance, Coinbase)

- Start small and never invest more than you can afford to lose.

- Diversify your crypto portfolio — don’t rely on just one coin.

- Follow news & updates — crypto is fast-moving!

Future of Crypto Finance

The future is bright:

- CBDCs (Central Bank Digital Currencies) will merge crypto with governments.

- Mass adoption is already happening via fintech apps.

- Regulations will bring more trust and mainstream entry.

- AI & Crypto integration will supercharge financial automation.

Final Thoughts

Crypto finance is not just an innovation — it’s a paradigm shift. Whether you’re a beginner, investor, business owner, or tech enthusiast, the crypto world offers new opportunities for financial freedom.

Those who learn, adapt, and act today will be the leaders of tomorrow.

The Future of Stock Market Trends That Will Redefine Investing Beyond 2030

Anyone else struggling to get into W88? w88linkvaow88thethao seems to be a reliable alternative link. Finally got access to the sports betting! Good stuff. You can find it here: w88linkvaow88thethao

KKWINapk, okay lah. Download dulu aplikasinya. Semoga gak berat di HP. Yang penting bisa main sambil santai di rumah. kkwinapk

Alright, so 9jljl… Not bad! The interface is clean and easy to navigate. The selection of games is pretty standard, but hey, maybe a little variety would be nice. Worth a look, for sure! Here’s the link: 9jljl

Looking for an alternative link for Sv388? I’ve been using sv388link and it’s been working out great. No problems accessing the site so far. Check here: sv388link

Hey folks! plataformadejogos is where it’s at! I played on plataformadejogos and had a good run. They have a really good variety of games, you should definitely give this one a go! Check it here: plataformadejogos

Okay guys, just tried rr88slot and it’s pretty cool! Lots of games to choose from, and so far, so good. Might be my new go-to spot. Check it out rr88slot!

pesomaxfun https://www.elpesomaxfun.com

phtaya https://www.rephtaya.org